Igniting Business Performance through Increasing Human Capital and Streaming Finance Performance

Igniting Business Performance through Increasing Human Capital and Streaming Finance Performance

The Gulf Cooperation Council (GCC) has developed a unified agreement for value-added tax (VAT) implementation among its Member States but with flexibility on some areas such as health care, education and real estate. Each Member State is to create and implement its own legislation without deviation to the commonly agreed principles (e.g., mandated registration for businesses with turnover of at least 375,000 AED).

One of the forerunners of the VAT implementation is the United Arab Emirates (UAE) with effectivity on the 1st of January 2018. Although VAT is not intended to tax a business, businesses across the country have inevitably facing numerous challenges and significant impacts from its forthcoming implementation. Experiences from other countries have shown that businesses need to have ample lead time to prepare before the actual adoption of VAT. The implementation itself connotes significant compliance costs, cash flow and process implications, and governance considerations. The senior management has a key role in the implementation to avoid any detrimental impact on the business. A well-managed VAT implementation will effectively benefit the business with respect to compliance and management risks, as well as, cash flow management.

Likewise, the UAE has already levied excise tax on certain products starting on the 1st of October 2017. The current implementation also brought up concerns to various businesses.

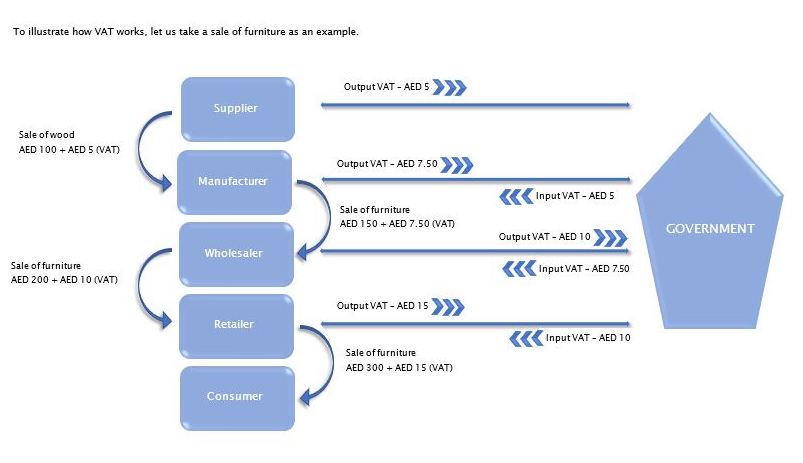

Value-added tax (or simply VAT) is an indirect tax that is applied for each stage in the supply chain. In other words, it is a tax paid by the consumer on the consumption of goods or services in addition to the price of the goods or services. VAT is ultimately the burden of the consumers and businesses act as tax collectors. Net result of VAT paid (input VAT) and collected (output VAT) is either claimed from or paid to the government.

VAT in UAE is charged at 5% of the invoice value (i.e., generally, sales less sales return, transportation and freight charges). Goods and services are, however, either subjected to a 5% rate, zero-rated or exempted.

Excise tax is the amount levied on products such as tobacco products, carbonated drinks and energy drinks. Tobacco products are defined as items listed within Schedule 24 of the GCC Common Customs Tariff and are subjected to 100% excise tax. Energy drinks or beverages containing stimulant substances are also subjected to 100% excise tax. On the other hand, carbonated drinks or aerated beverages are subjected to 50% excise tax.

With our years of experience to provide quality service and assistance to our valued clients, we provide a complete range of services to cover all the phases of the VAT and excise tax implementation from planning up to compliance and reporting to the government.

VAT AND EXCISE TAX PLANNING AND AWARENESS

Prior to the implementation, management should be able to identify the potential impact of VAT and excise tax to the business to minimize business risks. We assist in the preparation of a documented project plan to identify key stakeholders affected with the implementation and to cascade the plan throughout the entire organization. This includes set-up of a matrix to identify the roles of responsible units in the organization and conduct of a workshop to educate these units on VAT and excise tax.

VAT AND EXCISE TAX STRATEGY, SUPPLY CHAIN AND DEALS

Various transactions and supply chain processes will be impacted by VAT and excise tax such as procurement and production, technology and systems, sales strategy and marketing, legal implications and cash flow management to name some. On top of the potential impact, management should also identify the issues that will arise before and during the implementation. Our role is to assist the management in the identification and mapping relevant processes and transactions that will be affected by VAT and excise tax. This includes assistance in the customization of the IT set-up of the business to apply VAT and excise, accumulation of an issue log to be addressed in a timely manner and review and customization of source documents. Further, we present a high-level impact assessment of VAT and excise tax implementation and assist in the review of existing contracts with third parties.

VAT ALLOCATION MODELLING

VAT collections and payments should be netted against each other to determine either a liability to or claim from the government. However, calculation for liability and refund is not simple as it may seem. VAT payments should be appropriately identified to the related sale transaction. We assist in the preparation of a tax credit allocation model to ensure reasonable amount of liability to or claim from the government.

VAT AND EXCISE TAX REGISTRATION

To avail of the benefits of VAT and excise tax, it is proper that businesses are registered with the Federal Tax Authority (FTA). Our aim is to provide comfort to businesses in complying with all legalities to register VAT and excise tax from completion of relevant documents up to timely submission. We assist in the identification of transactions to determine if the business meets the minimum threshold for mandatory registration for VAT. We also provide advice on applicability of other registration schemes (e.g., group VAT registration).

VAT COMPLIANCE AND ASSURANCE

Compliance does not end upon registration of the business to the relevant authority. We provide support to the timely submission of VAT and excise tax returns and reconciliations to the government. Prior to the submission, we review the details of the VAT and excise tax records, returns and reconciliations to verify accuracy of information. Further, we provide advice to management on VAT and excise tax clarifications and FTA notifications, represent them before the FTA for tax matters and discuss appraisal on compliance.